Discover What You're Really Paying for Payment Processing

Most small business owners think they're paying 2.9% but are actually paying 4.5% or more. Find out your true costs and get a plan to reduce them.

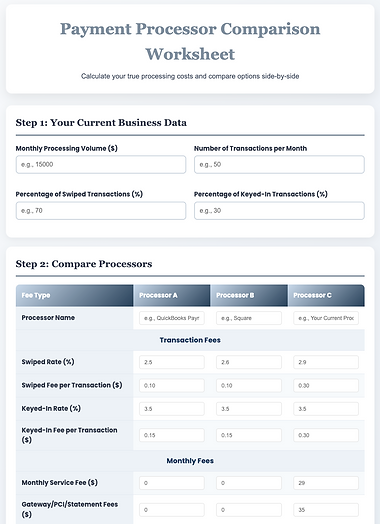

Stop guessing at your payment processing costs. This worksheet reveals hidden fees, calculates your true effective rate, and shows you exactly where you can save money. Takes 2 minutes to complete, could save you thousands.

Stop Losing Money to

Payment Processing Surprises

Reveal Your True Processing Costs

That 2.9% rate you think you're paying? It's probably closer to 4.5% once you factor in hidden fees. Our worksheet shows you exactly what you're really paying.

Spot Red Flags Before You Sign

Avoid processors with hidden contract terms, excessive termination fees, or rates that seem too good to be true. Our worksheet includes warning signs to watch for.

Get Equipment and Contract Guidance

Decide whether to lease or buy equipment, avoid long-term contracts, and address any existing expensive agreements. Make informed choices about total ownership costs.

Compare Processors Side-by-Side

Stop jumping between processor websites trying to decode their marketing speak. Our tool lets you compare QuickBooks® Payments, Square, and others using your actual transaction data.

Calculate Your Annual Savings Potential

See exactly how much you could save by switching processors. The worksheet shows monthly and annual cost differences, plus break-even analysis for switching costs.

Find the Best Fit for Your Business Type

Service businesses need different features than retail stores. Our tool helps you identify which processor works best for your specific industry, transaction types, and business model.

Access Your Access Your Payment Processing Interactive Worksheet

Ready to find out what you're actually paying? This interactive worksheet does the heavy lifting for you - just plug in your numbers and see your real costs, potential savings, and which processors work best for your business type.